No country in the world stands independent

from its neighbours. Over the last century, a web of trade has developed

between countries, and it is largely responsible for the economic development

we’ve seen, due to the economic theory of comparative advantage. In short, it

postulates that certain economic actors can produce certain goods or services

at a lower opportunity cost than others. To maximize economic output, then, it

makes sense to produce that which a certain country produces at lower cost than

anyone else and export it, and then import those goods which can be produced by

other countries at a lower cost.

Thus, every nations imports some goods and

services and exports others. These two do not always match, however, and this

mismatch is called the balance of trade. The balance of trade is a large part

of a country’s current account – which not only includes trade, but also

capital flows in and out of an economy. Usually, countries produce a trade

surplus during economic boom times, and then records a deficit during tougher

times.

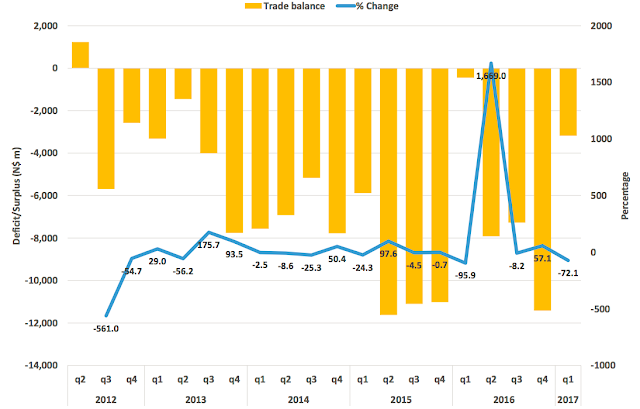

Namibia, however, while seemingly

experiencing an economic boom until recently, nevertheless managed to record

trade deficits ever since quarter 3 of 2012, peaking at a trade deficit per

quarter of almost N$ 12 billion in the second quarter of 2015. Clearly when a

country consistently imports more than it exports, it effectively exports

locally created wealth abroad. It is thus of national importance to examine

trade numbers when they are released to see exactly where our wealth is going,

and what we are getting in return. So let us take a look at the Quarterly Trade

Statistics Report for the first quarter of 2017, as released by the Namibia

Statistics Agency.

In the first quarter of this year, our

trade deficit was N$ 3.1 billion – down 72% from the fourth quarter of 2016, so

a bit of an improvement. This is the result of N$ 20 billion in imports, versus

N$ 16.9 billion in exports, both of which declined against the previous

quarter, with total trade down 11.4 percent. Over the last 5 years, the trade

deficit averaged N$ 6 billion per quarter, mostly due to Namibia’s demand for

high-valued manufactured commodities and machinery, while all we were exporting

was primary goods.

Let’s take a look at exports and imports

individually. Namibia’s largest export market, as usual, is the Southern

African Customs Union, with N$ 4.8 billion exported to that group of countries,

or 32.7% of our exports. In second place is the European Union, with N$ 3.5

billion in exports (23.6%), then the European Free Trade Area (basically

Norway, Iceland, Switzerland and Liechtenstein) with N$ 3.4 billion in exports

(23%), followed by non-SACU SADC with N$ 1.4 billion (9.7%) in exports, and

finally, the Common Market for Eastern and Southern Africa (COMESA) with N$ 1.1

billion (7.5%) in exports.

When we take a look at the individual

countries we export to, South Africa comes out top with N$ 3.2 billion exported

to, or 19% of our exports, with Export Processing Zones another N$ 1.75 billion

(10.3%), Norway at N$ 1.7 billion (10.1%), Botswana with N$ 1.6 billion (9.5%)

and Switzerland N$ 1.3 billion (7.9%). Together, these 5 account for 56.8% of

our exports. Export Processing Zones are areas designated by the Ministry of

Industrialization, Trade and SME Development with incentives for exporting

manufactured goods, and it is gratifying to see they’ve expanded this much

already.

Norway and Switzerland stand out, however,

and to see the truth behind those countries appearing so high on our list, we

need to dig a bit deeper, and take a look at what exactly is being

exported. For Norway, 99.8% of its

exports relate to vessels, which implies the SS Nujoma, Debmarine’s diamond

exploration vessel, was ‘exported’ to Norway for outfitting before commissioning.

We can thus hopefully expect a similarly valued import in future.

For Switzerland, we can see the majority of

exports are copper ores and copper cathodes. This seems to be the result of the

Louis-Dreyfus Group, based there, that via its subsidiary, Dundee Precious

Metals, acquired the Tsumeb Smelter, and seems to be importing copper from

Bulgaria and elsewhere to Namibia for smelting before re-exporting. Other

exports to Botswana, South Africa and the EPZ area is mostly diamonds, with

South Africa also importing mineral fuels and oils, live animals, fish and

beverages.

In terms of imports, the SACU is by far the

largest source of imports, with N$ 13.1 billion imported, or 67.8% of our

imports. The EU is second with N$ 2.3 billion (12.1%) imported, then the BRIC

countries with N$ 1.5 billion (7.7%) imported, COMESA with N$ 1.1 billion

imported (5.6%), and Non-SACU SADC at N$ 1 billion (5.4%) imported. Taking a

look at the individual countries we import from, South Africa stands at N$ 11.2

billion, accounting for 55.9% of our imports, with Botswana at N$ 1.8 billion

(9.4%), Zambia at N$ 991 million (4.9%), China at N$ 939 million (4.7%) and

Bulgaria at N$ 669 million (3.3%)

From South Africa, we source vehicles,

boilers and most of our manufactured products as well as pharmaceuticals, as

can be expected. This is the main reason the Namibian dollar cannot delink from

the Rand. Botswana’s imports are mainly diamonds – most likely re-imported

after processing there. Zambia and Bulgaria we import copper ore from – for

smelting, as mentioned above. China, of course, also provides vehicles and

boilers and manufactured products, as can be expected, seeing as their products

remain quite popular here in Namibia.

Based on this quick overview then, we can

see a picture emerging from the data. Quite a bit of our imports and exports

can be traced to two rather large multinational companies operating in Namibia.

We still do not have adequate capacity to process our own diamonds, given the

diamond trade with Botswana. And we remain quite dependent on South Africa for

our supply of manufactured goods. It is clear Namibia still has some way to go

before we can truly stand on our own feet – but if the growth of the Export

Processing zones are any indication, we are certainly on our way there.

No comments:

Post a Comment