Here in Namibia, we’ve grown used to

examining the reports released out by Statistician General Alex Shimuafeni and

the Namibia Statistics Agency to gauge our economic health. Unfortunately, our

own health does not paint a complete picture – the country, after all, does not

exist in isolation, but is part of the global economy. Where then would we look

to find out how the rest of the world is doing? Well, the World Economic Studies

Division of the Research Department at the International Monetary Fund in

Washington DC can help us on that front. Every 6 months, they release a World

Economic Outlook to inform us as to how the world is doing, economically.

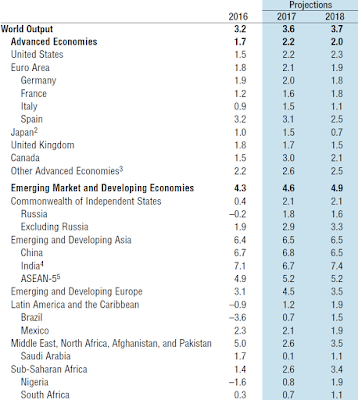

So what does the October 2017 report

reveal? Well, after struggling through most of 2016 at a paltry 3.2% growth, it

appears the world economy is picking up steam again, with 2017 growth expected

to be 3.6%. Central Banks across the world have begun tightening monetary

policy again (raising interest rates) as growth slowly returns, but it’s not

all good news. It remains problematic that not all countries are participating

in the recovery, and while growth is increasing, inflation – and specifically,

wage inflation – remains low. This means that the new growth is not being

funnelled to the ordinary people, and economic inequality is on the increase.

So let’s dig a bit deeper into the details,

starting with the so-termed ‘Advanced Economies.’ In the United States, growth

for 2017 is expected to increase to 2.2%, less than expected, as President

Trump’s election promised of fiscal policy expansion has yet to come to pass.

Further hampering the US’s growth is its lack of productivity growth and aging

workforce. In the Euro area, growth is expected to rise to 2.1% on the back of

a growth in exports and smaller political risk. However, similar to the US,

weak productivity growth and an aging workforce will stymie growth, alongside

the problem of excessive debt still faced by some countries in the Euro area.

In the United Kingdom, growth is expected

to drop to 1.7% going forward, with the pounding taken by the Pound Sterling

depressing consumption. With Brexit details not yet confirmed, future growth is

also likely to be muted until the extent of the country’s relationship with the

euro area is finalised. Japan is similarly on a downward path, with expected

growth of 1.5%, but going forward, the country’s shrinking labour force will

curtail growth. In other advanced economies, growth accelerates, however, with

Norway (1.4%), Canada (3%), Australia (2.2%), Korea (3%) and Singapore (2.5%)

benefitting from the recovery in global trade.

Now let’s have a look at the Emerging

Market Economies. First amongst these is of course China, with growth projected

to be 6.8%, well on their way to their target of doubling GDP between 2010 and

2020. However, much of this growth has been funded by debt, which has

ballooned, so risks increase there as well. In the rest of Asia, the economies

are doing quite well too, with India being a standout, despite still

experiencing disruptions associated with their currency exchange initiative,

and they’re expected to grow by 6.7% this year.

In Latin America and the Caribbean, GDP

growth is returning to 1.2% in 2017 after contracting by 1% in 2016. Mexico leads the way in this region, even

though a renegotiation of the NAFTA agreement is on the cards, and Brazil is

once again experiencing economic growth as well. The biggest issue in the

region is the continuing political uncertainty in Venezuela, whose economy is

expected to contract by 10% in 2017. In the Commonwealth of Independent States

(or Russia and the former USSR countries) conditions continue to improve, with

growth in the region expected to be 2.1%. This coincides with Russia finally

struggling out of its two-year recession, with expected growth of 1.8%.

In developing Europe, growth is expected to

be 4.5%, driven by a recovery in exports, and lead by Turkey (5.1%) and Poland

(3.8%). In the Middle-East and North African region, however, growth is slowing

to 2.6% from 5% in 2016, mainly due to a renormalization of Iran’s growth after

it sped up significantly in 2016 after sanctions ended. Pakistan is expected to

lead in growth, with 5.3% expected in 2017 due to investment in the

Pakistan-China Economic Corridor.

Finally, our own neck of the woods –

sub-Saharan Africa. By now we have good comparisons with the rest of the world

to show just how we’re doing. Well, the region as a whole is expected to grow

by 2.6% this year, but we have sizable differences between countries, and the

big outliers are Nigeria, which is only now starting to recover from the oil

price shocks of 2016, with growth for 2017 projected at 0.8%. South Africa, the

other large economy, is also facing growth of just 0.7% despite recoveries in

the commodities markets and agricultural exports on the rise due to good rains.

However, the political uncertainty continues to sap not only consumer

confidence, but growth as well. Angola, on the other hand, will grow by about

1.5% this year, off the back of a rebound in oil production, and for the rest

of the region, an average growth of 3.9% is expected this year.

So what does this mean for us? When we take

a step back to see the whole world economy at a glance, we can see that no one

economy is without its challenges. But we can also see that every recession has

a solution, with quite a few countries pulling themselves up by their

bootstraps. We’ve been blessed with quite a few years of exceptional growth,

and now seem stuck in a recession. But the proof is out there. If we Harambee,

we too can return to solid growth.

No comments:

Post a Comment